Sanoma Corporation complies with the Finnish Corporate Governance Code issued by the Securities Market Association in 2019 and in force as of 1 January 2020. The Finnish Corporate Governance Code is available at www.cgfinland.fi.

Corporate Governance Statement 2023

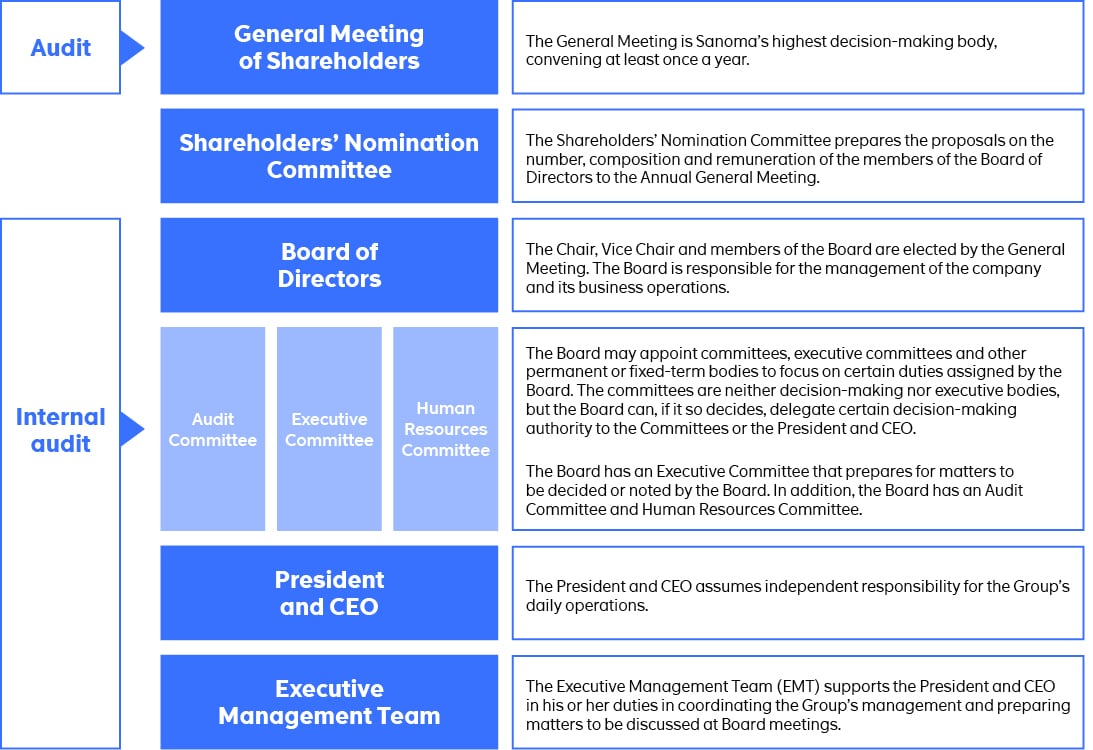

Governance structure

In its operations and governance, Sanoma follows laws and regulations applicable in its operating countries, ethical guidelines set by the Sanoma Code of Conduct as well as the Group’s internal policies and standards. Sanoma’s administrative bodies are the General Meeting of Shareholders, the Board of Directors (‘Board’) and its committees, the President and CEO and the Executive Management Team (‘EMT’).